**Car Financing Rises by 7.5% Over the Last Month: Implications for Consumers and the Auto Sector**

In a significant change within the automotive landscape, car financing has increased by 7.5% in the previous month, as indicated by the latest industry statistics. This considerable rise mirrors shifts in consumer habits, changing economic circumstances, and wider trends in both the automotive and financial industries. Here’s what this surge signifies for car purchasers, lenders, and the auto sector as a whole.

### Deciphering the Increase

Car financing encompasses the loans and credit arrangements that consumers utilize to acquire vehicles. An increase of 7.5% in financing activity points to a growth in either the volume of financed vehicle sales, the typical loan size, or both. Various factors might be driving this pattern:

1. **Escalating Vehicle Costs**: Due to ongoing inflation and supply chain challenges, the average price of both new and used vehicles remains elevated. Consequently, more consumers are resorting to financing options to afford their purchases.

2. **Interest Rate Changes**: Even as interest rates have fluctuated, several lenders have rolled out promotional financing deals to entice buyers, especially as inventory levels begin to stabilize. Such offers can render financing more attractive than paying the full amount upfront.

3. **Accumulated Demand**: Following months of restricted inventory and postponed purchases, numerous consumers are re-entering the market. This revitalized demand is propelling financing activity as buyers finally proceed with vehicle acquisitions.

4. **Trend Towards Latest Models**: As electric vehicles (EVs) and cars featuring the latest technology gain traction, consumers are increasingly inclined to finance higher-priced models to gain access to contemporary features.

### Consequences for Consumers

For consumers, the 7.5% rise in car financing may bring both advantages and drawbacks:

– **Enhanced Access to Vehicles**: Financing enables a greater number of individuals to afford vehicles they might not otherwise be able to purchase outright, particularly during times of elevated prices.

– **Increased Debt Exposure**: Conversely, heightened financing can result in greater household debt, especially if consumers opt for long-term loans with substantial interest rates.

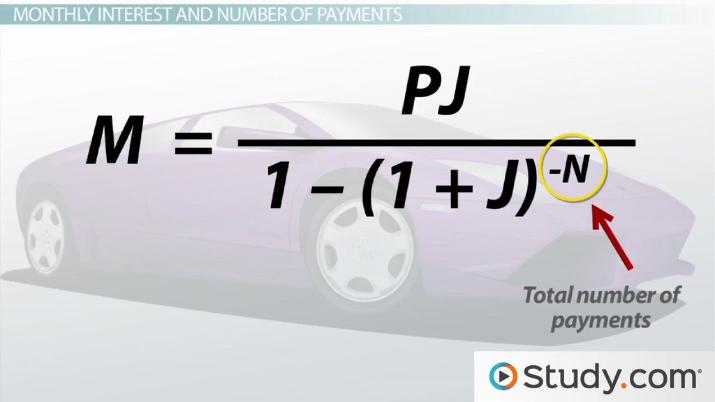

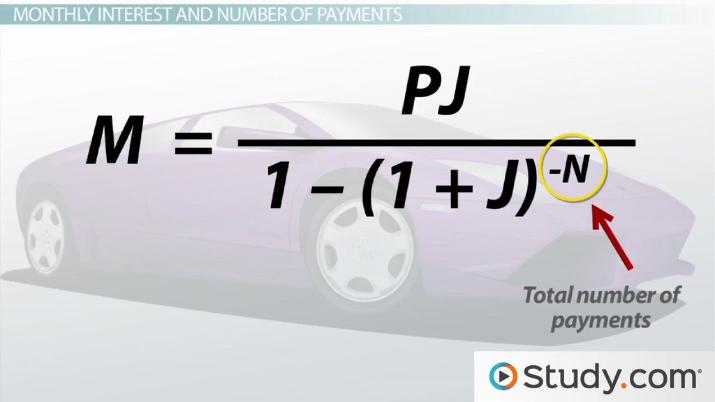

– **Importance of Financial Understanding**: With more consumers participating in financing, grasping loan specifications, interest rates, and overall repayment costs becomes vital to avoid financial difficulties.

### Effects on the Auto Sector

The increase in car financing is an encouraging indication for automakers and dealerships:

– **Sales Boost**: An upswing in financing typically coincides with improved vehicle sales, benefiting both manufacturers and dealerships.

– **Inventory Control**: As financing alternatives entice additional buyers, dealerships can better optimize inventory turnover, notably with the arrival of new models.

– **Chances for Lenders**: Financial establishments and auto lenders may experience heightened business, leading to increased competition and innovation in financing products.

### Future Outlook

While the 7.5% rise in car financing serves as a robust indicator of market activity, experts warn that its sustainability hinges on several elements, such as interest rate fluctuations, economic stability, and consumer confidence. Should inflation continue to abate and employment levels remain sturdy, the financing trend might endure or even expand.

Nevertheless, should economic unpredictability heighten or interest rates escalate further, consumers may adopt a more cautious approach, potentially dampening the financing momentum.

### Summary

The recent 7.5% rise in car financing highlights a vibrant phase in the automotive sector. For consumers, it underscores the necessity of prudent financial planning and comprehension of loan terms. For the sector, it signifies a resurgence in demand and a possible transformation in the purchasing and selling of vehicles. As the market progresses, staying informed will be essential for anyone looking to buy, sell, or finance a vehicle in the upcoming months.