**Strategies for Decreasing Automobile Ownership Costs**

Having a vehicle can pose a considerable financial strain, with expenditures reaching beyond the initial buying price. From insurance costs to maintenance and fuel, the expenses can swiftly accumulate. Nevertheless, there are many tactics that vehicle owners can adopt to lower these costs and render car ownership more economical.

1. **Select the Appropriate Vehicle:**

Picking a car with a lower buying price, superior fuel efficiency, and a solid reliability record can greatly lessen ownership expenses. Think about choosing a pre-owned vehicle, which can save money on depreciation, or a fuel-efficient model to reduce gas costs.

2. **Routine Maintenance:**

Following a regular maintenance routine can avert expensive repairs in the future. Basic tasks like oil changes, tire rotations, and brake checks can prolong the lifespan of your vehicle and enhance its performance, ultimately saving money.

3. **Compare Insurance Options:**

Car insurance rates can vary significantly among providers. It’s wise to compare and review quotes from various insurers. Furthermore, consider bundling insurance policies, raising deductibles, or leveraging discounts for safe driving or low mileage to reduce premiums.

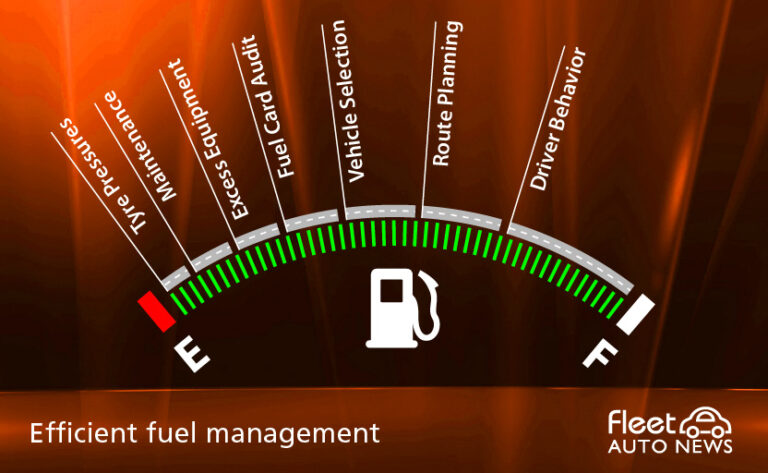

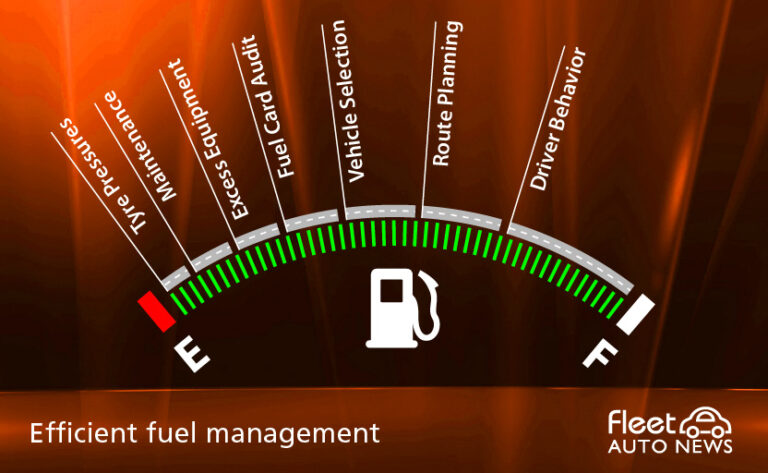

4. **Drive Smart:**

Implementing fuel-efficient driving practices can decrease fuel usage and save money. Steer clear of aggressive driving, maintain a constant speed, and utilize cruise control on highways. Regularly checking tire pressure and minimizing excess weight in the car can also enhance fuel efficiency.

5. **Explore Carpooling or Ridesharing:**

Sharing rides with others can markedly lessen fuel and maintenance expenses. Carpooling to work or utilizing ridesharing services for occasional trips can diminish the distance driven, resulting in reduced fuel costs and decreased wear on your vehicle.

6. **Minimize Unnecessary Driving:**

Organize trips effectively to lessen unnecessary driving. Merge errands into a single journey and use navigation apps to discover the quickest routes. Moreover, contemplate alternative transportation methods such as biking, walking, or public transit for short distances.

7. **Refinance Your Auto Loan:**

If you have a high-interest auto loan, refinancing it at a more favorable rate can lower monthly payments and the overall interest accrued throughout the loan’s duration. Make sure that the refinancing terms are advantageous and do not unnecessarily extend the loan period.

8. **Self-Perform Repairs and Maintenance:**

For those who possess handy skills, carrying out simple repairs and maintenance jobs can help save on labor expenses. Numerous online resources and tutorials exist for tasks such as changing air filters, replacing windshield wipers, or even conducting oil changes.

9. **Take Advantage of Fuel Rewards Programs:**

Many fuel stations provide rewards programs that offer discounts on fuel purchases. Enrolling in these programs or utilizing credit cards that give cashback or rewards on fuel purchases can lead to savings over time.

10. **Assess Your Need for a Vehicle:**

Reflect on whether car ownership is essential for your lifestyle. In urban areas with efficient public transportation, relying on transit, car-sharing services, or occasional rentals may be more economical than owning a vehicle.

By applying these tactics, vehicle owners can notably ease the financial burden of car ownership, making it more manageable and sustainable in the long run.